Budgeting Advantages for Families

This post may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases.

Sadly, many families have financial problems at the end of the month or have difficulties with eliminating their debt. In fact, its more common than not in the U.S. 🙁

If you also have similar issues, a great way to help combat your finances is to prepare a budget. Due to the many budgeting advantages, you could manage your money more effectively and you could avoid being short on cash as the end of the month approaches- which is great for boosting your quality of life and not living in stress.

Plus, you will have a better chance at reaching your family’s financial goals as well. (Yay!)

Creating and implementing a budget may require some additional work but it is worth it because budgeting advantages will make it up to you for your efforts. Fortunately, there are many frugal tips for families that make budgeting much easier.

If you would like to know more about the benefits of budgeting for families, keep reading because this is what we will talk about today.

8 budgeting advantages for families

1. You will get a clear picture of your family’s finances

One of the biggest benefits of budgeting is that it gives you an understanding of your family’s finances. This is because you know where the money you have to use sparingly comes from, where the money is being spent throughout the month and you can also see how much money you have left each month.

Clarity is such an important first step. After all, how can spending be optimized if you don’t know what you’re current spending habits are?! (Seems simple but actually writing it out can be eye opening!)

2. You can track your family’s spending

Another advantage of budgeting is that you can track your family’s spending. Since you have a list of all your monthly expenses, for example, utility bills, insurances, groceries, mortgage, gym membership, karate class for the kids, etc., you can go through the list any time you want. Most likely, you will discover some spending that is absolutely needless or excessive. For example, your family often eats out, orders food, or spends too much money for entertainment purposes. (I’m all for entertainment- but there are tons of budget friendly ways to spend time together too!).

If your family struggles with making the ends meet, it may be beneficial to eliminate unnecessary items on your list of spending. Like do you really need to order pizza so often? (I know, I know… it’s a tough question). You could save a lot of money if you make your own pizza at home. Plus, it is super fun to make pizza with the kids! 🙂

Related read: 15 FRUGAL TIPS TO SAVE YOU MONEY AT THE GROCERY STORE

3. You will be more organized

If you break your expenses down into categories, you can easily realize any changes in your finances. For example, if a company raises a bill, you will see it immediately. Staying organized can be a great advantage when it comes to reducing your spending.

If you want, you can also use an application such as Mint for budgeting and tracking your monthly expenses. It will make budgeting so easy!

4. You will be prepared for unexpected expenses

There is nothing worse than an unexpected expense when you are already tight on budget. However, a plumbing issue, a sudden visit to the hospital, or a washing machine that stops working can cause extra expenses for your family (and stress) and they can occur at any time. That’s why it is important to make a plan for these events and have some savings in advance. This way you won’t get into trouble and you can cover the unexpected costs when they appear.

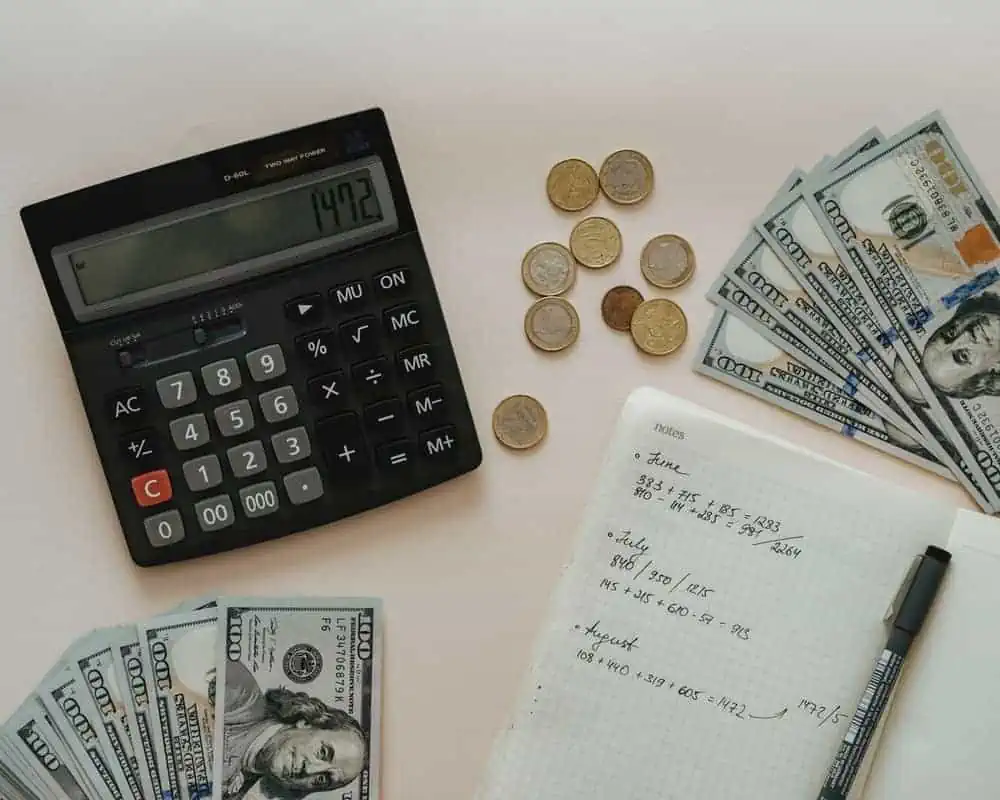

Fortunately, budgeting can also help you set aside some money each month and build up an emergency fund. You should aim for saving at least 1000 or 2000 dollars, and this one should be your top priority. (This mean may no more coffee at Starbucks until you save at least this amount of money:))

5. You can achieve your financial goals more easily

Having a budget helps your family set financial goals and you can also achieve them more easily. To do that, first, you need to think about what you would like to accomplish financially in the next few months or years. For example, if you would like to save some money for retirement, your children’s education, or a big family vacation, then you have to set them as a goal. Then, depending on your income, you can allocate a certain amount of money each month for these purposes.

Just by setting these financial goals, you will be less likely to spend money on unnecessary items or activities.

Another benefit of planning is that when for any reason your income increases, you can allocate proportionately more money towards the goals, so you can achieve them earlier.

6. You can decrease your debt

Many people go into debt because of credit card spending, taking out a loan for a new car, a new house, or going to college. But paying off the credits is not always easy. In fact, when it comes to personal finance, this is one of the biggest challenges for families.

However, developing a budget can be an effective method of paying down debt. Since budgeting allows you to control your spending, you can free up some money for making additional payments on your debt. If each month you pay more than the required minimum payment, you can pay off the debt in a shorter amount of time.

7. You will be less worried

If you are one of those who are constantly worrying about finances, then budgeting can be a life-changing experience for you. When you are preparing a budget, you can see both your total income and expected expenses. So if you notice that you may have some difficulties with paying for the bills in that month, you can take some actions to cut back on your unnecessary spending.

Budgeting is a great way to plan your finances, change your bad spending habits and avoid being stressed out about your financial situation.

Related read: HOW YOU CAN MAKE LIVING ON ONE INCOME WORK

8. You can set an example for your kids

The last one on our list of budgeting advantages is that you can set an example for your kids. As a mom, it is important to teach your children about financial responsibility early on. When you are budgeting, you set a positive example for your kids. They will see that by making a budget you can reduce your expenses and save some money (without taking all the fun out of life of course!).

If your kids are old enough, you can involve them in the budgeting process. You can collect some ideas together about how you could cut back household expenses (for example, how you can reduce the electric energy consumption), and later show them how much money you were able to save with their amazing ideas and efforts.

Related read: 24 WAYS TO PREPARE FOR BABY ON A BUDGET

[convertkit form=1551829]

The bottom line

If you have never tried budgeting, as you can see from the above-mentioned budgeting advantages it is worth creating and following a budget. Don’t worry, it doesn’t mean that you are not allowed to enjoy your time and have fun anymore. You can still do it! The difference is that you will know your financial limitations and you will understand what you can afford to spend money on.

While talking about budgeting, I want to make sure that you use a budget to make your life easier- NOT stressful. I have spent different stages of my life (for example as a college kid) worrying about every penny, but it probably affected my mental health more than I realized. So only use a budget strategy if it will help you feel your best mama!

And one thing is sure: when your family will see the results (especially your savings account) they will appreciate your efforts!

Do you keep a family budget? If so, what is your favorite strategy? Did any of these tips help you feel motivated to start or change your strategy? I’d love to hear in the comments!